Lake Land College Backs 12-Year Extension for Mattoon’s Midtown TIF District

The Lake Land College Board of Trustees has thrown its support behind a 12-year extension for the City of Mattoon’s Midtown Tax Increment Financing (TIF) Redevelopment Project Area, a move aimed at continuing economic growth and public infrastructure improvements.

The board unanimously passed a resolution on June 9 supporting the extension of the TIF district, which was established in 2001 and is nearing the end of its original 23-year term. As a local taxing body, the college’s support is a crucial step for the city as it seeks special state legislation to prolong the district’s life.

TIF districts work by capturing the increase in property tax revenue (the “increment”) generated by new development within a specific area. This captured revenue is then reinvested into the district to fund public improvements, incentivize private projects, and spur further economic development.

In a memo to the board, Lake Land College President Dr. Josh Bullock outlined the significant impact the Midtown TIF has had since its inception. According to city reports, the district has attracted over $6.6 million in private investment and leveraged $3.3 million in public funds, creating a private-to-public investment ratio of nearly two-to-one.

“The City and the Mattoon Midtown TIF District have generated substantial community benefits by unlocking economic development, supporting private reinvestment, and improving public infrastructure,” Bullock stated.

Bullock’s report noted that the TIF has supported over 90 redevelopment projects to date, with expenditures topping $1 million in fiscal year 2022 alone. He said these investments have encouraged small businesses, promoted the reuse of vacant buildings, and helped build “a resilient and welcoming community core.”

By passing the resolution, the board formally pledges its support for the 12-year extension and agrees to provide a letter of support to be packaged with those from other overlapping taxing bodies. The package will be sent to state legislators to introduce the required amendment to the Illinois General Assembly.

Bullock explained that extending the TIF would allow the city to complete its redevelopment goals for the area and continue to expand the tax base for all local taxing entities, including the college.

The resolution states that while the city has made “significant progress toward accomplishing the stated goals of Midtown TIF… there is work left to be done.” Extending the district, it continues, will “enable the City to complete the redevelopment of the area and expand the tax base of the overlapping taxing bodies.”

The motion to approve the resolution was made by Trustee Chuck Deters and seconded by Trustee Denise Walk, passing with a unanimous roll call vote. The college’s support now paves the way for the City of Mattoon to formally pursue the legislative action needed to secure the district’s future.

Latest News Stories

WATCH: Sonya Massey bill requiring full employment history for police candidates now law

Republicans respond to data showing 10M will soon lose Medicaid coverage

DOGE can access sensitive data at federal agencies, appeals court rules

Chicago group says Illinois officials break laws as they blast Trump

Musk has coalition support in lawsuit threat against Apple over App Store treatment

WATCH: Trump ‘considering’ lawsuit against Fed chair

Inflation holds steady amid trade war threats

Report: Average American household will benefit from ‘big, beautiful bill’ tax cuts

Pritzker continues fielding presidential question ahead of State Fair rally

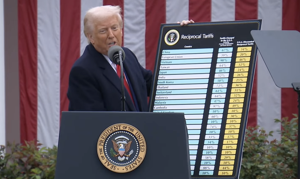

Whitmer takes a stand against tariffs; meets with Trump

WATCH: Illinois In Focus Daily | Tuesday Aug. 12th, 2025

Governor to evaluate tax proposal for Bears stadium in Arlington Heights