Op-Ed: Main Street businesses, customers would bear brunt of a tax on services

Even as lawmakers reconvene in Springfield for the fall veto session, special interest groups continue to press for higher taxes on everyday services – such as haircuts, tax filings, and vehicle repairs – to fund their pet programs.

Last week, a memo circulating around the capitol included a potential $2.7 billion statewide service tax, euphemistically dubbed as “Sales Tax Modernization.”

This proposed tax on services would disproportionately hit Main Street businesses and their customers.

It would apply to everyday services that working families and seniors depend upon, such as home repairs, haircuts, pet care, accounting, tax services, landscaping, and vehicle repairs.

These services are normally provided by local small businesses – plumbers, landscapers, beauticians, accountants, electricians, lawyers, mechanics and many, many others.

These small businesses have been fighting to contain costs and limit price increases for their customers even as inflation has wrecked the buying power of everyday Americans.

It hasn’t been easy. Most small businesses have already had to raise prices to cover their costs and keep their doors open. Many have seen their customer base dwindle as fewer working Americans and seniors can afford the goods and services offered by Main Street businesses.

Too many consumers have been priced out of the market after years of rising costs. They are having to choose between home repairs, car repairs, or other basic services and putting healthy, wholesome food on their kitchen tables or keeping their thermostat at a comfortable temperature.

Putting a new tax on services will exacerbate this challenge for seniors and working families. As everyday Illinoisans are forced to cut back on spending and delay projects and services, Main Street businesses will bear the brunt of these reduced expenditures.

In addition to a decreasing customer base, small businesses will also have to absorb higher costs themselves. They will have to administer and collect the new service tax, which will impose new paperwork and administration costs on their businesses. They will also pay higher costs for the services that their business requires to operate – legal services, facility and equipment maintenance services, accounting and tax services, etc.

Small businesses lack the capacity to absorb more cost increases, so these costs will also have to be passed along to already stretched customers, further exacerbating affordability issues for price conscious consumers.

Legislators on both sides of the aisle in Springfield have voiced discomfort with this direct tax on working Illinoisians. Even as special interest groups continue to press for a service tax, many legislators understand how detrimental it would be to Main Street businesses and their customers. The ongoing affordability crisis makes it critical that the Illinois General Assembly shuts down these lingering rumors and talk of a service tax.

The last thing Illinois needs is a new tax on everyday services. Let’s let small businesses continue to do what they do best – serve their customers!

Latest News Stories

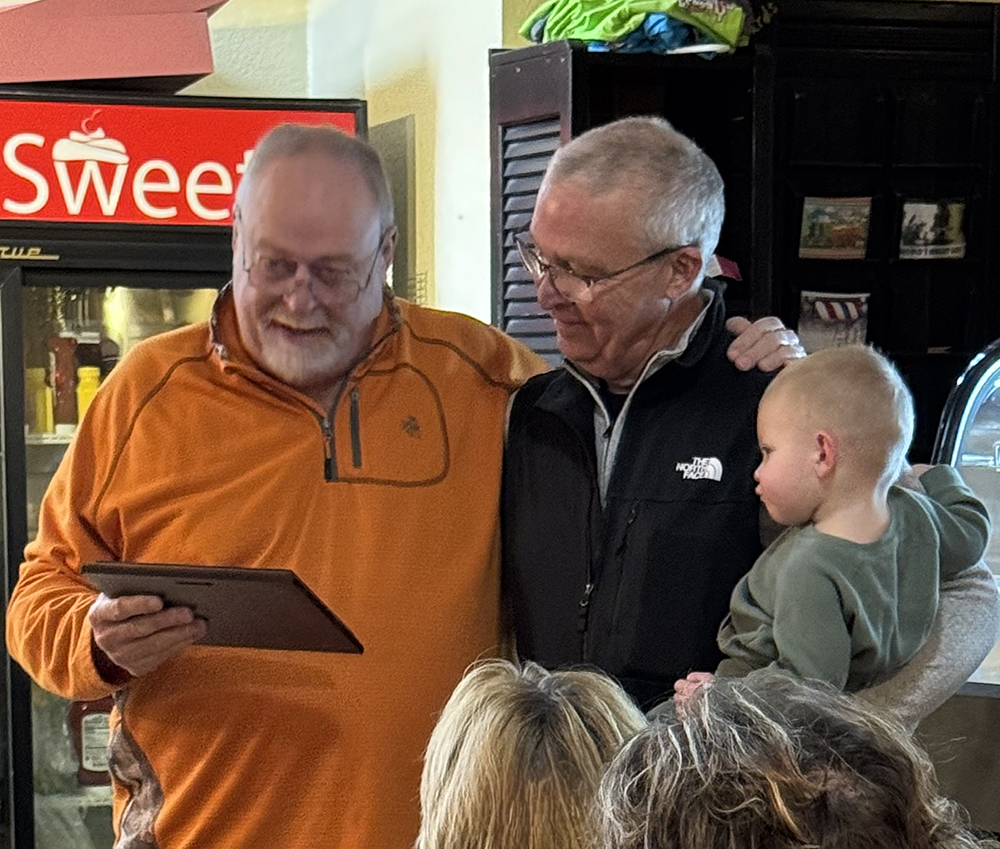

Casey Officials Honor Utilities Superintendent Shelby Biggs at Retirement Celebration

Moore Notches Double-Double in Casey-Westfield Loss to Robinson

Meeting Summary and Briefs: Casey City Council for Dec. 3, 2025

Council Moves to Increase Utility Reconnect Fees to Curb Non-Payment

Altamont Stifles Casey-Westfield Offense in 34-12 Victory

Adoption of 2025 Comprehensive Plan Sets Future Course for City of Casey

Candy Canes on Main Marks 10th Anniversary with New Ice Rink and Expanded Festivities

Lady Warriors celebrate 21-win season, honor top performers at banquet

New online portal to track universities’ foreign funding live in 2026

IL U.S. House candidate: drug screen expectant moms getting subsidies

Illinois quick hits: Ameren requests rate hike; Pearl Harbor remembrance

Sen. Mark Kelly says Trump and Hegseth can’t silence him