Everyday Economics: Housing costs moderate even as overall prices drift higher

Last week’s economic data painted a picture of an economy sending mixed signals, with resilient housing activity colliding against stubborn inflation and an uncertain policy backdrop. As the Federal Reserve prepares for its widely anticipated interest rate decision this week, the data offers both reassurance and reasons for concern.

The housing market delivered an unexpectedly positive surprise. Existing-home sales rose 1.5% in September to reach 4.06 million homes on a seasonally adjusted annual basis, according to the National Association of Realtors. More impressively, sales jumped 4.1% compared to the same period last year.The timing matters. September’s closings reflect contracts signed in August, when 30-year mortgage rates dropped 15 to 20 basis points from their late July peaks. That brief window of affordability appears to have coaxed both buyers and sellers off the sidelines, creating what Zillow’s latest market report describes as “unseasonably resilient” activity. The momentum should extend into October’s data as mortgage rates moderated further ahead of the Fed’s September rate cut. Still, the overall picture remains subdued, with Zillow forecasting just 4.07 million home sales for the full year 2025—a mere 0.3% improvement over 2024. House price growth and rent growth are moving lower. The inflation data told a more complicated story. Despite the ongoing government shutdown, the Bureau of Labor Statistics released September’s Consumer Price Index on schedule. At first glance, the numbers looked encouraging. Headline CPI rose 0.3% for the month while core CPI (which excludes volatile food and energy prices) increased 0.2%—both coming in below economist expectations.But the year-over-year figures reveal a troubling trend. Headline inflation now stands at 3%, while core inflation has accelerated to 3.6%. Both measures have been drifting higher since March, shortly after the announcement of sweeping new tariffs. This timing is more than coincidental. It suggests that inflation expectations—what businesses and consumers believe about future prices—matter enormously in determining actual price movements. When tariffs were announced, consumers and businesses began adjusting their strategies in anticipation, and those expectations became self-fulfilling.Within the inflation data, housing costs emerged as the unlikely hero. Housing inflation has cooled to its lowest rate of increase since 2021. Owners’ equivalent rent, which measures what homeowners would pay to rent their own homes, is up 3.8% year-over-year. Actual rents have risen just 3.4% annually—the slowest pace since November 2021. These components carry substantial weight in the overall CPI calculation, and their moderation has helped prevent inflation from climbing even higher.The juxtaposition is striking: housing costs, which typically lag other economic indicators by several months, are finally delivering the disinflation that economists have long anticipated. This is likely to continue over the next year as the rental market continues to soften. Meanwhile, tariff-driven price increases in goods are pushing inflation in the opposite direction.This week brings the Federal Reserve’s next policy decision, with markets expecting another 25 basis point rate cut. The central bank faces an increasingly difficult balancing act. The labor market is stalling, wage growth is decelerating, and residential investment continues to decline. These factors argue for continued monetary easing to support economic activity.Yet inflation remains stubbornly above the Fed’s 2% target and appears to be moving in the wrong direction. The government shutdown only complicates matters, limiting the flow of timely economic data that policymakers rely on to make informed decisions. Flying blind in such circumstances elevates the importance of sound macroeconomic theory over raw data analysis.The coming months will test whether the positive trends in housing inflation can offset tariff-driven price pressures elsewhere in the economy—and whether the Fed can successfully navigate between supporting growth and containing inflation.

Latest News Stories

Illinois law mandates pharmacies to sell needles, sparking safety debate

Report warns U.S. national debt predicted to pass $53 trillion by 2035

Courts remain firm against unsealing grand jury records from Epstein trial

White House TikTok garners 1.3 million views in 24 hours

Newsom responds to Bondi’s letter on sanctuary policies

U.S., NATO military officials discuss Ukraine security guarantees

Illinois quick hits: Governor bans school fines; Target fires hundreds over fraud

Industry advocates: More state regulation will drive insurance rates higher

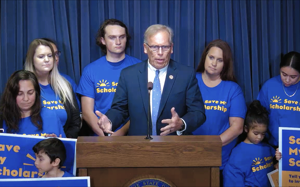

Lawmakers, policy groups react to social media warning suit

From Mexico to Knoxville, five cartel leaders wanted in drugs, weapons conspiracy

Trump administration pushes to remove noncitizen Medicaid enrollees

“Candy Canes on Main” Gets Green Light for Parade, Donation

Public education budgets balloon while enrollment, proficiency, standards drop