Everyday Economics: Rate cut debate: Reading mixed signals in a fragile economy

The Federal Reserve cut interest rates last week, but the decision was far from unanimous. Two members of the Federal Open Market Committee (FOMC) dissented – an unusual occurrence that reveals deep disagreement about where the economy is heading. Even more striking: the dissenters pulled in opposite directions. One wanted no rate cut at all, believing the Fed should hold steady. The other favored a more aggressive half-percentage-point reduction. This split would be challenging enough under normal circumstances, but the Fed faces an extraordinary handicap: it’s flying blind.

Official economic data hasn’t been updated in over a month, forcing policymakers to make consequential decisions based on incomplete information, anecdotal evidence and private-sector estimates. The challenge isn’t just that the economy is sending contradictory signals – it’s that many of the most important signals aren’t being sent at all.

Two Competing DiagnosesThe dovish perspective, articulated by the newest Fed Governor Stephen Miran, rests on a critical technical point: the “neutral rate” of interest may be lower than previously thought. The neutral rate is the level at which monetary policy neither stimulates nor restricts economic activity – essentially the speed limit for the economy. Miran argues that recent policy changes – tariffs, immigration – are likely to reduce America’s long-term economic potential, which in turn means the neutral rate has declined. If he’s right, keeping interest rates at current levels amounts to slamming the brakes far harder than intended.The evidence for this view is visible in two critical sectors. The labor market has cooled considerably, with hiring slowing to barely a trickle. Meanwhile, the housing market remains frozen, with potential buyers locked out by elevated mortgage rates. These aren’t signs of a healthy economy being gently guided toward stable prices – they suggest an economy being actively choked.Kansas City Fed President Jeff Schmid sees things differently. In his view, monetary policy is only “modestly restrictive” at best. His evidence? Look at financial markets, he argues. Stock markets hover near record highs. Companies can borrow cheaply. To understand why this matters, consider that when corporations issue bonds, they must pay higher interest rates than the U.S. government does on Treasury bonds – investors demand this premium to compensate for the added risk of lending to a company rather than to Uncle Sam. This difference is called the “spread.” Right now, these spreads are extremely narrow, meaning corporations are paying only slightly more than the government to borrow. Narrow spreads signal that investors feel confident about corporate creditworthiness and are willing to accept minimal compensation for risk. In Schmid’s view, this indicates easy financial conditions – if monetary policy were truly restrictive, nervous investors would demand much higher premiums to lend to corporations, widening these spreads considerably.Moreover, Schmid points to robust economic activity. Consumer spending remains solid and actually accelerated through the summer. Most telling, he notes, is that business investment in equipment and software – xectors that should be sensitive to interest rates – has been booming. Software spending’s contribution to GDP growth hit a record in the second quarter. Information technology investment in the first quarter reached its highest level since the dot-com bubble of 2000.With inflation still elevated, Schmid concludes, the Fed should keep demand steady to give supply chains and businesses time to expand capacity and ease price pressures.The Labor Market’s Warning SignsBut here’s where Schmid’s optimistic reading runs into trouble: the labor market data tells a darker story. Employment growth has essentially stalled. Hiring rates remain depressed across the economy. Only half of U.S. industries are still adding workers – meaning half are treading water or shrinking – and definitely not committing to any major expansion plans.The government shutdown compounds these headwinds, leaving thousands of federal workers without paychecks. These workers will inevitably cut back on spending, creating ripple effects throughout the economy. The frozen labor market means most workers won’t see meaningful raises this year, effectively eliminating the risk of a wage-price spiral that has worried inflation hawks. When workers’ paychecks don’t keep pace with inflation, they reduce spending. And since consumer spending comprises roughly 70% of U.S. economic activity, even modest pullbacks create significant drag.What’s AheadThis week, Fed officials will deliver several speeches, offering further insight into policymakers’ thinking. The ISM surveys will reveal whether business activity is accelerating or decelerating. The ADP employment report will provide a preview of labor market conditions.Unfortunately, we face yet another month without the official Bureau of Labor Statistics jobs report, leaving us to piece together the employment picture from alternative sources. Private-sector data from ADP, Indeed, and LinkedIn all point to the same troubling conclusion: labor demand remains deeply sluggish.State unemployment claims offer one sliver of reassurance. The labor market hasn’t deteriorated sharply over the past month – layoffs haven’t surged dramatically. But that’s an extraordinarily low bar. The absence of mass layoffs doesn’t signal economic health; it may simply mean we’re experiencing a slow-motion weakening rather than an acute crisis.The Fed’s divided vote reflects genuine uncertainty about where this economy is headed. For now, policymakers have threaded the needle with a modest rate cut. But whether that proves sufficient – or too much – won’t become clear until Congress ends this government shutdown and official data resumes. The longer the shutdown drags on, the higher the risk that the economy slides into recession while the Fed operates in the dark, unable to respond effectively to a crisis it cannot fully see.

Latest News Stories

Bipartisan lawmakers reintroduce DACA protections

Routh guilty on all charges in plot to kill Trump

Trump, Zelenskyy meet as Russia accused of violating NATO nations’ air space

WATCH: IL governor on photo with wanted suspect: ‘No way to vet everybody’

Illinois quick hits: Constitutional amendment would guarantee parental rights

Oversight committee expands probe on ‘politically motivated’ debanking

‘Brutal slog:’ Government shutdown looms as bipartisan negotiations derail

WATCH: Republican leader: says Pritzker budget cut EO a ploy for IL tax increases

Nebraska attorney general sues Lorex over Chinese surveillance concerns

Colorado pushes ahead on clean energy as EV funding returns

Trump lectures UN, Western Europe for policy failures

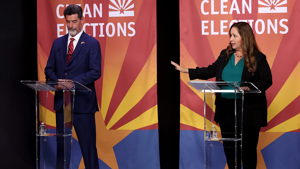

Arizonans vote on successor to U.S. Rep. Raúl Grijalva