Analysis: Trump’s proposed tariff rebate would cost twice as much as tariffs

President Donald Trump has again floated the idea of sending Americans $2,000 from tariff revenue, but a new analysis suggests the import taxes won’t bring in enough money to cover the proposed checks.

Trump’s tariff rebate suggestion comes a week after the Supreme Court sharply questioned his authority to impose tariffs under a 1977 law that he has used to justify the bulk of the tariffs announced on April 2, which he dubbed “Liberation Day” for U.S. trade. The cases challenging Trump’s tariff authority remain pending before the nation’s highest court, but even if the revenue source were not in question, Trump could face challenges in getting the checks out to taxpayers.

Trump brought up the idea over the weekend and again on Monday.

“All money left over from the $2,000 payments made to low and middle income USA Citizens, from the massive Tariff Income pouring into our Country from foreign countries, which will be substantial, will be used to SUBSTANTIALLY PAY DOWN NATIONAL DEBT,” Trump wrote in a social media post.

Trump provided no details, but at least one group has already worked up an estimate.

The Committee for a Responsible Federal Budget said the math doesn’t work on Trump’s proposal, according to its analysis. The group stated that if the payments were structured like the COVID-19 stimulus payments, the $2,000 dividend would cost about $600 billion, which is about twice as much as tariffs are expected to generate this year.

“Current tariffs have raised about $100 billion so far, and will raise about $300 billion per year in the steady state,” CRFB noted. “If paid annually, dividends would be twice as expensive as tariffs.”

The group suggested that if the checks were be paid every other year starting at the end of next year, it might not raise costs, but would take longer.

“If the Supreme Court upholds the lower courts’ rulings against the tariffs, it would take seven years before the first dividend could be paid on a revenue neutral basis,” CRFB said.

CRFB also said the nation’s $38 trillion in debt must be addressed.

“Under no circumstances is the government doing enough to pay down debt, despite the claims to the contrary,” it noted.

Trump has said he wants to use tariffs to restore manufacturing jobs lost to lower-wage countries in decades past, shift the tax burden away from U.S. families and pay down the national debt. Economists, businesses and some public companies have warned that tariffs will raise prices on a wide range of consumer products.

Trump’s Liberation Day tariffs have been challenged in federal courts as unconstitutional by some business groups and Blue states, who argue that only Congress has the authority to enact tariffs.

The U.S. Supreme Court last week heard oral arguments in a consolidated case challenging the tariffs. During that hearing, Justice Amy Coney Barrett inquired about the rebate process, one of several indications that members of the Supreme Court were skeptical of Trump’s claimed power over the purse in the case.

Trump’s rebate idea comes as he seeks to convince voters that he has made things more affordable for working Americans.

Trump previously suggested $2,000 rebates for taxpayers using savings from Department of Government Efficiency cuts.

In August, Treasury Secretary Scott Bessent said federal debt was the top priority.

“We’re going to bring down the deficit to GDP,” he said in a TV interview. “We’ll start paying down the debt, and then at that point that can be used as an offset to the American people.”

Bessent has estimated the tariffs will generate about $300 billion a year.

Exit polls from last Tuesday’s elections showed voters were focused on pocketbook issues, including prices at the grocery store. While gas prices have fallen since Trump took office, others have increased significantly, including coffee (up 18.9%) and ground beef (up 12.9%). Those exit polls also track with pre-election polling from The Center Square, which found prices were top of mind for voters. Democrats won most of the key races on Tuesday, frustrating Republicans ahead of the 2026 midterms.

Trump has said his tariffs are helping to keep the U.S. financially afloat. That contradicts arguments made by Trump’s Solicitor General, D. John Sauer, before the Supreme Court last Wednesday. During that hearing, Sauer said the tariffs were regulatory in nature and not intended to raise revenue.

CRFB said the tariff rebates could boost U.S. debt.

“Using income from tariffs to pay dividends would mean that income could not be used to reduce deficits or offset borrowing from the One Big Beautiful Bill Act,” CRFB noted. “Using all the tariff revenue for rebates would push debt to 127% of Gross Domestic Product (GDP) by 2035 instead of 120% under current law; if $2,000 dividends are paid annually, debt would reach 134% GDP.”

The U.S. debt stands at about $38 trillion, according to the U.S. Department of Treasury.

Last Wednesday, Supreme Court justices questioned attorneys on both sides of a case challenging Trump’s tariff authority.

Twelve states, five small businesses and two Illinois-based toymakers have challenged Trump’s authority to impose tariffs under a 1977 law without Congressional approval. That law, the International Emergency Economic Powers Act, doesn’t mention the word “tariff” and has never been used to impose tariffs.

Trump’s legal team argues that the law is a clear delegation of emergency power, granting the president broad authority to act in times of crisis.

The Supreme Court is expected to decide the case before the end of June, if not sooner.

Trump has said he wants to use tariffs to restore manufacturing jobs lost to lower-wage countries in decades past, shift the tax burden away from U.S. families and pay down the national debt. Economists, businesses and some public companies have warned that tariffs will raise prices on a wide range of consumer products.

A Congressional Budget Office report from August estimated tariffs could bring in $4 trillion over the next decade. That CBO report came with caveats and noted that tariffs will raise consumer prices and reduce the purchasing power of U.S. families.

U.S. Sen. Josh Hawley, R-Mo., introduced the American Worker Rebate Act, legislation that would send rebate checks to working Americans of at least $600 per adult and dependent child (or about $2,400 for a family of four).

That bill remains stalled in the Senate.

Earlier in his second administration, Trump and former adviser Elon Musk floated the idea of returning money to taxpayers through the Department of Government Efficiency. Musk’s DOGE initially expected to find $2 trillion in savings by cutting waste fraud and abuse. However, Musk has since left the White House and DOGE was on track to save about $150 billion as of an April cabinet meeting.

Latest News Stories

Exclusive: Colorado lawmakers split over limits on taxes

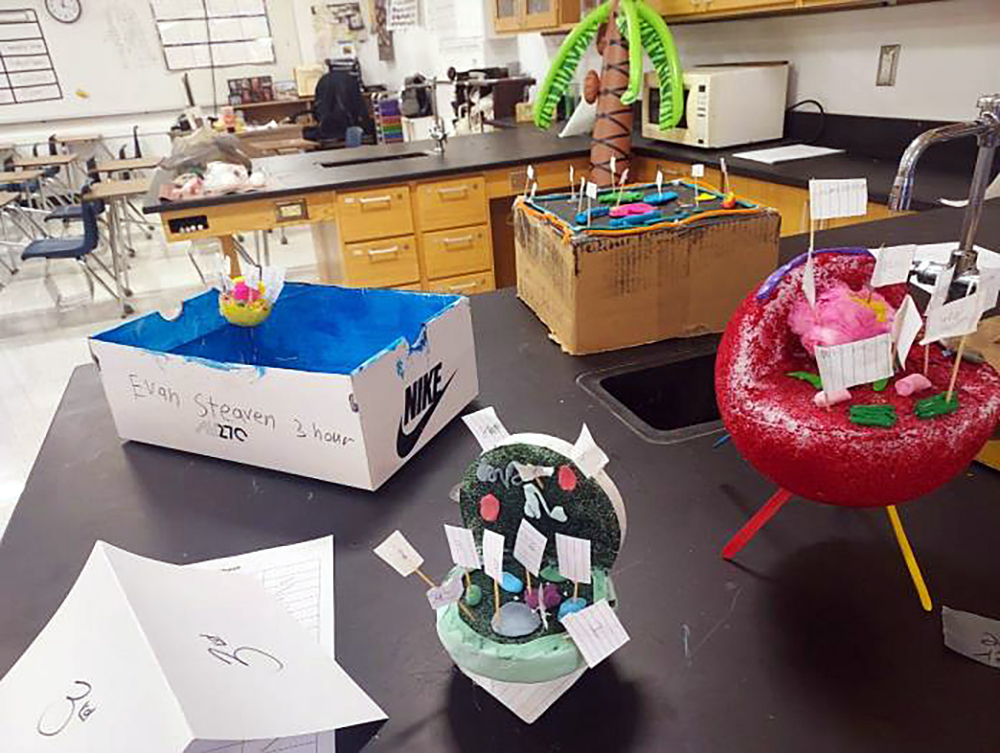

Casey-Westfield Schools Showcase Student Success in Academics, Athletics, and Arts

A Week of Warrior Pride: Homecoming at Monroe Elementary

Americans on Social Security will see 2.8% benefits boost next year

Better-than-expected inflation report generates cut predictions

Op-Ed: 340B needs transparency to fulfill Its mission

India’s Reliance says it will abide with sanctions on Russian oil purchases

From Creative Cells to Chemical Reactions: Science in Action

Marshall Edges Lady Warriors in Thrilling Senior Night Matchup

Critics warn Illinois’ ‘megaproject’ tax breaks shift costs to taxpayers

WATCH: Pritzker creates accountability commission amid increased immigration enforcement

Casey City Council Passes Ordinance Holding Parents Responsible for Minors’ Vandalism