Everyday Economics: Jobs data returns as government reopens

With the government shutdown finally over, this week brings a double dose of good news: federal workers start receiving paychecks again, and economic data collection resumes. Both matter more than you might think.

Why the Reopening Matters

When federal workers and contractors receive their paychecks, they resume spending on everyday goods and services – providing a modest boost to economic activity. The longer a shutdown persists, the larger its drag on GDP growth through this reduced consumption channel and its spillover effects.

More importantly for markets, the data blackout is ending. The Federal Reserve has been flying blind, making monetary policy decisions without fresh government data. This week’s release of the delayed September jobs report – though backward-looking – will provide crucial visibility on whether employment had begun to fall before the data went dark.

Jobless claims had stopped rising, and private-sector indicators suggested hiring remained soft even as layoffs stayed low. While we’ll likely never see October’s data because of the collection gap, having the September and November reports will give the Fed at least some visibility heading into its December rate decision.

This Week’s Housing Focus

The main event this week will be housing data, starting with the NAHB Housing Market Index (builder confidence) on Tuesday.

Builder confidence should show improvement. The recent drop in mortgage rates has meaningfully improved affordability, spurring stronger-than-typical autumn activity.

Zillow data is already telling an unusual story. New listings, which fell 3% year-over-year in August, reversed course to show 3% growth in September. For context, new listings typically plummet 9% from August to September (based on the seven-year average), making this year’s modest 2% monthly decline remarkably resilient.

After August’s summer doldrums, this unseasonable strength from both buyers and sellers suggests October’s existing home sales data (released next week) could surprise to the upside. Watch for a modest increase in transaction volumes – a welcome change from the frozen market conditions we’ve seen for much of 2024.

Latest News Stories

Lower U.S. oil production projected in 2026

GOP leader disputes Newsom’s comments on Colbert’s show

‘Ivy League’ doesn’t mean excellent medical schools, according to new index

Report: ‘weaknesses’ and ‘unusual increases’ found in management of Ukrainian aid

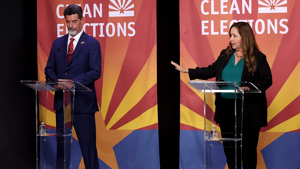

WATCH: Illinois lawmakers clash over election consolidation and compulsory voting

Gubernatorial candidate calls for reason, peace outside Illinois ICE facility

Report: Soros foundation gave $80M to groups tied to ‘extremist violence’

Colorado economists warn of potential recession, cite tariffs

Colombian President calls for criminal charges against Trump over boat strikes

More than 2 million deportations, self-removals in less than 250 days

Illinois quick hits: Officer charged in straw gun case

WATCH: Pritzker looks for 4% ‘efficiencies’ after increasing spending 43% since 2019