Report: Average American household will benefit from ‘big, beautiful bill’ tax cuts

The average American household will see their resources increase over the next 10 years due to the tax cuts in the One Big Beautiful Bill Act, according to the most recent Congressional Budget Office analysis.

These gains, however, will vary across the income distribution, with middle class and upper class households projected to see their resources increase, while households in the lowest tax of the seven tax brackets will likely see a decrease.

The OBBBA, among other things, codified the 2017 Tax Cuts and Jobs Act’s boosted maximum standard deduction, cross-bracket tax cuts and the Child Tax Credit. It also implemented temporary tax deductions for tips and overtime pay, capped for single filers at $25,000 and $12,500, respectively.

Middle class and upper class Americans will benefit most from these tax changes, with CBO predicting that households in the middle of the income distribution, or the fifth and sixth tax brackets, will see their resources increase anywhere from $800 to $1,200 annually.

Households in the highest tax bracket will see their resources increase about $13,600 annually, roughly 2.7% of their income.

CBO estimates an $1,200 annual decrease for households in the lowest tax bracket – roughly 3% of their income – primarily due to the OBBBA’s new eligibility requirements for Medicaid and SNAP funding changes.

The bill, which all Democrats opposed, reforms Medicaid by requiring able-bodied adults without dependents to fulfill work-related requirements, correcting cases of duplicate coverage, and removing noncitizens illegally living in the U.S. from rolls.

Additionally, able-bodied SNAP recipients who have taken advantage of states’ work requirement loopholes will likely lose benefits as the OBBBA makes states shoulder more of the program’s cost.

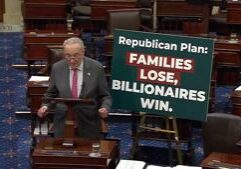

In scathing statements Monday, Democrats pointed to the CBO’s analysis as evidence that the legislation will reward higher-income earners at the expense of the poorest Americans.

“Once again the data makes it clear: Republicans’ Alice in Wonderland agenda rewards those at the very top and punishes American families trying to make ends meet,” Senate Minority Leader Chuck Schumer, D-N.Y., said. “Democrats have fought this ‘Big, Ugly Betrayal’ tooth and nail and will continue to expose the Republicans’ agenda for the damage it is already doing.”

Republicans countered that the reforms to Medicaid and SNAP will actually help the most vulnerable Americans by shoring up the programs for those who really need them.

“The Democrat lies have been loud, but the truth is louder,” House Committee on Energy and Commerce Brett Guthrie, R-Ky., said in a statement. “The One Big Beautiful Bill Act is a win for American families—especially expectant mothers, their children, low-income seniors, and people with disabilities.”

Latest News Stories

Whitmer takes a stand against tariffs; meets with Trump

WATCH: Illinois In Focus Daily | Tuesday Aug. 12th, 2025

Governor to evaluate tax proposal for Bears stadium in Arlington Heights

Illinois quick hits: Report shows rate of businesses leaving state

Report: New York No. 2 in nation for inbound tobacco smuggling

Lake Land College Hires Philadelphia Firm for $100,000 Digital Marketing Campaign

Trump delays China tariffs by 90 days

Kennedy visits Atlanta’s CDC

DCFS denies claim that agency uses uncertified interns to investigate families

Trump declares ‘Liberation Day’ in D.C., calls in National Guard

Illinois quick hits: State-based health insurance marketplace approved

Judge denies Trump DOJ request to unseal Ghislaine Maxwell grand jury records