First day of government shutdown leaves Wall Street unfazed

The first day of the first federal government shutdown in years didn’t seem to disrupt Wall Street, as both the S&P 500 and the Dow Jones Industrial Average closed at record highs Wednesday.

The S&P finished the day at 6,711.20, up 0.34% from Tuesday. The broad market index also saw an intraday record. The Dow Jones Industrial Average rose 43.21 points, or 0.09%, to close at 46,441.10. The Nasdaq composite climbed 95.15 points, or 0.42%, ending the day at 22,755.16.

A rally in pharmaceutical stocks caused health care to lead the S&P, a day after the administration unveiled a new deal with Pfizer based on a May executive order for most-favored-nation pricing.

Wednesday’s market performance comes at the start of the first government shutdown since 2018, according to reports, and less-than-stellar jobs reports.

Though the Bureau of Labor Statistics is part of the shutdown and has said it won’t be releasing its usual monthly jobs report on Friday, data from payroll and HR services provider ADP reflected a decline of 32,000 private-sector jobs. This was well under projections from economists, who had forecast at least 40,000 new jobs in September.

In addition, the Congressional Budget Office has estimated that about 750,000 government employees will be furloughed as a result of the shutdown; however, it is unclear just how long the shutdown will last. Both the president and vice president have indicated layoffs will be coming if it continues.

More job loss does mean, however, that the Federal Reserve will likely cut interest rates again at its next meeting in October. After months of pressure from the administration, the Fed reduced interest rates by 0.25% in September due to a cooling labor market.

Latest News Stories

Texas House passes Congressional redistricting bill after absconding Dems return

Department of Education ends support for political activism

Illinois trucker warns foreign firms faking logs, dodging rules, risking safety

Illinois law mandates pharmacies to sell needles, sparking safety debate

Report warns U.S. national debt predicted to pass $53 trillion by 2035

Courts remain firm against unsealing grand jury records from Epstein trial

White House TikTok garners 1.3 million views in 24 hours

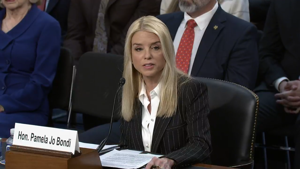

Newsom responds to Bondi’s letter on sanctuary policies

U.S., NATO military officials discuss Ukraine security guarantees

Illinois quick hits: Governor bans school fines; Target fires hundreds over fraud

Industry advocates: More state regulation will drive insurance rates higher

Lawmakers, policy groups react to social media warning suit