US oil production reached record-high 13.6 million barrels a day in July

The United States produced a record-high 13.6 million barrels of crude oil per day in July, up from 13.5 million barrels per day (b/d) in June, the Energy Information Administration (EIA) said in its latest Short-Term Energy Outlook.

U.S. crude oil production in July was higher than previously estimated, prompting the agency to raise the starting point of its forecasts for the remainder of 2025 and 2026. The agency now projects U.S. crude oil production will average 13.5 million b/d in both 2025 and 2026. For the remainder of 2025, this represents a 100,000 b/d increase from the agency’s August forecast, while 2026 oil production was projected 200,000 b/d higher.

The agency also raised its forecasts of crude oil production in the Gulf of America in 2025 and 2026, noting that some offshore drilling projects are ramping up output faster than expected.

The EIA expects global production of crude oil and petroleum products to increase through 2026, leading to continued growth in international inventories. The agency projects this inventory growth will put downward pressure on global oil prices, with benchmark Brent crude declining to an average of $62 per barrel in the fourth quarter of 2025 and to $52 per barrel in 2026. Brent crude oil spot prices averaged $68 per barrel in September.

The EIA said a key uncertainty in its forecast is the pace at which China continues to purchase oil to put into storage. If China continues to build inventory at the pace estimated in recent months, crude oil prices could be higher than now forecast, the agency said.

The agency projects U.S. dry natural gas production will reach 107 billion cubic feet per day (Bcf/d) in 2026, up 1.0 Bcf/d or about 1% from the EIA’s previous forecast. U.S. dry natural gas production in 2024 averaged approximately 103.5 Bcf/d, according to the agency.

The market price of natural gas at the Henry Hub in Louisiana is expected to rise from an average of $3 per million Btu in September to $4.10 per million Btu in January 2025, according to the EIA’s forecast. The agency expects the Henry Hub price in January will be 50 cents lower than was projected in September, primarily because U.S. gas production will be higher than previously expected. Early Wednesday, the spot price for natural gas at the Henry Hub was at $3.38 per million Btu.

The EIA projects U.S. LNG export capacity will increase by 5 Bcf/d in the remainder of 2025 and in 2026 as production continues to ramp up at the Plaquemines LNG facility in Louisiana and the Corpus Christi plant in Texas. The additional capacity should increase total U.S. LNG exports to 15 Bcf/d in 2025 and to 16 Bcf/d in 2026, up from 12 Bcf/d in 2024, the agency said.

Latest News Stories

Chicago posts fewest homicides since 2016, arrests rate also declines

Three years later, Inflation Reduction Act blamed for higher Medicare costs

Illinois quick hits: Prosecutors charge two more in Tren de Aragua case; Senate Energy and Public Utilities Committee meets today; Illinois Little League team loses in World Series

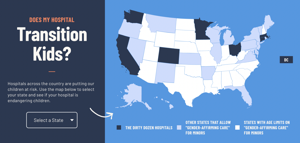

Report: Human Rights Campaign pressures transgender procedures on minors

Everyday Economics: Housing market and Fed policy in focus in the week ahead

Businesses brace for new tax challenges amid global tariff focus

Illinois takes over health insurance marketplace in 2026 amid skepticism

WATCH: IL state reps challenge IEMA-OHS responses to local agencies

Judge expands restraining order against ‘Beto’ O’Rourke, adds ActBlue

Reversing Biden’s precedent, students complete FAFSA in minutes at beta-testing event

Trump, Zelenskyy to meet Monday in steps toward peace with Russia