Supreme Court won’t let lawmaker intervene in tariff challenge

The U.S. Supreme Court denied a move from a Montana lawmaker seeking to intervene as the high court takes up a challenge to President Donald Trump’s tariff authority.

Montana state Sen. Susan Webber, rancher Jonathan St. Goddard, and Rhonda and David Mountain Chief asked the nation’s highest court to intervene in the case because Trump’s tariffs “directly burden cross-border commerce of these tribal plaintiffs, who operate small businesses and family ranches near the U.S.-Canada border.”

Trump’s team at the Justice Department said Webber shouldn’t be allowed to intervene at this point, suggesting that Webber file a friend-of-the-court brief in the case instead.

The Supreme Court did not explain its decision on the request to intervene: “The motion of Susan Webber, et al. for leave to intervene is denied.”

Webber’s attorney, Monica Tranel, had argued the group should be allowed to intervene in the case.

“This case presents unique and crucial issues that are distinct from those already before the court,” Tranel wrote in the motion. “These claims are not merely about the commercial legality of tariffs but are rooted in fundamental constitutional principles and a unique body of federal Indian law.”

Tranel and Webber didn’t immediately respond to questions from The Center Square about the Supreme Court’s decision on intervention.

Trump used a 1977 law that doesn’t mention tariffs to reorder global trade through tariffs to try to give U.S. businesses an advantage in the world market. Using tariffs under the International Emergency Economic Powers Act, Trump hit nearly every nation with import duties of at least 10%. Some countries face higher rates, up to 50%.

Two lower courts have already said the 1977 International Emergency Economic Powers Act doesn’t give the president unbounded tariff authority. In late August, the U.S. Court of Appeals for the Federal Circuit affirmed a previous lower court ruling, but said Trump’s tariffs could remain in place while the administration appeals to the U.S. Supreme Court. In the 7-4 decision, the majority said that tariff authority rests with Congress.

The Supreme Court set oral arguments for Nov. 5.

New tariffs raised $80.3 billion in revenue between January 2025 and July 2025 before accounting for income and payroll tax offsets, according to an analysis of federal data from the Penn Wharton Budget Model.

Trump has said he wants to use tariffs to restore manufacturing jobs lost to lower-wage countries in decades past, shift the tax burden away from U.S. families and pay down the national debt.

A tariff is a tax on imported goods paid by the person or company that imports the goods. The importer can absorb the cost of the tariffs or try to pass the cost on to consumers through higher prices.

Economists, businesses and some public companies have warned that tariffs could raise prices on a wide range of consumer products.

Latest News Stories

Lake Land Seeks State Funding for Major Renovations to Four Campus Buildings

Energy advocate applauds oil and gas commingling updates

Texas legislature passes redistricting map, governor to sign into law

Lake Land College Board Reviews Balanced $60.8 Million Operating Budget for FY 2026

Meeting Summary and Briefs: Clark County Board for July 18, 2025

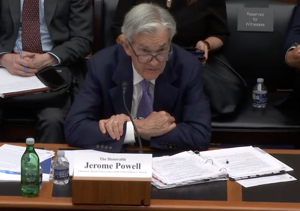

Dow hits record high after Fed Chair hints at September rate cuts

WATCH: Newsom optimistic about redistricting despite poll

Newsom meets with Danes, talks about Trump but not 2028

CA bill to give interest on insurance payments to homeowners

DOJ releases Maxwell interview transcripts, audio; described Trump as ‘gentleman’

Erik Menendez denied parole; brother appears before board

After cutting union contracts, VA redirects $45M to veterans