Congressional Conflicts: Stock ban pits affluent, super rich

Washington has become synonymous with polarization between Republicans and Democrats.Yet, legislation that would bar elected officials from owning stocks reveals an additional fault line: supporters tend to be affluent white-collar professionals, while opponents made their millions by founding businesses and/or making investments on Wall Street, an investigation by The Center Square found.

The divide contrasts with near uniformity among ordinary Americans for a ban on politicians trading stocks. They believe lawmakers use information gleaned behind closed doors to enrich themselves, such as members of Congress who bought or sold stock at the start of the COVID-19 pandemic in early 2020 or before President Donald Trump’s announcement about the putative risk for pregnant mothers to take Tylenol.Capitol Hill lawmakers are required to report their trades within 30 or 45 days. As The Center Square has reported, many violate the deadline with little if any fine or punishment.This summer, 16 House members signed up as cosponsors of draft legislation to ban lawmakers from trading stock. Half were Republicans. Half were Democrats.While their partisan affiliations differed, their income status did not. All but one were in the bottom half of the economic scale among 535 lawmakers, according to Quiver Quantitative, a website that tracks lawmaker’s wealth. U.S. Rep. Chip Roy, a Texas Republican, the bill’s lead sponsor, is a former attorney, investment banking analyst, and congressional staffer. Despite his white-collar credentials, the 53-year-old has a net worth of $1.3 million, a figure that puts him as the 300th wealthiest lawmaker.

Roy’s main Democratic cosponsor, U.S. Rep. Seth Magaziner, of Rhode Island, has a similar professional background. Forty-two, Magaziner has a lower net worth, $651,000, a sum that puts him as Congress’ 373rd richest member.

Other notable cosponsors include U.S. Reps. Alexandria Ocasio Cortez, a New York Democrat, whose net worth of $49,000 makes her the 475th wealthiest lawmaker on Capitol Hill, while Tim Burchett, a Tennessee Republican, is worth $41,500, a sum that puts him at the 477th wealthiest.

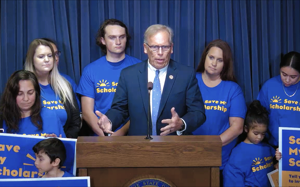

U.S. Rep. Anna Paulina Luna, a Florida Republican, said the bill would reign in wealthy investors on Capitol Hill. “No one sent to Congress should be enriching themselves through Wall Street while writing the very laws that regulates our markets,” Luna said at a press conference Sept. 4. Her net worth, at $590,000, puts her as Congress’ 384th wealthiest member.In July 30, the 15 members of the Senate Committee on Homeland Security and Government Affairs met to vote on legislation to ban the president, vice president, and members of Congress from owning stock. The outcome was partisan. Only the bill’s sponsor, U.S. Sen. Josh Hawley, a Missouri Republican, joined all seven Democrats on the panel to vote to advance the legislation. Yet the bill’s most outspoken opponents were among Congress’ richest members.

One was Sen. Ron Johnson, a Wisconsin Republican. A cofounder of a plastics manufacturing firm, the 70-year-old Johnson has a net worth of $67.3 million, a figure good enough for 22nd place in Congress. At the committee hearing on July 30, Johnson said the legislation should be renamed “the career politician-protection act because it would make it so unattractive for people … to run for office and … give up their business and sell it unless some ethics committee said it won’t be a conflict of interest.”Another opponent was U.S. Sen. Rick Scott, a Florida Republican. Scott, 72, is the third wealthiest member of Congress, with an estimated net worth of $507.1 million.

At the July 30 hearing, he suggested his route to riches was different from white-collar professionals on the committee. Instead of attending “some elite university,” he worked his way up from growing up in public housing to founding and running businesses, including HCA Healthcare, one of the nation’s largest hospital chains. He was then elected governor of Florida before going on to Congress. “Somehow, I’m suspect because I made money. Do any of you want to be poor?” Scott asked. “I don’t. It’s disgusting what’s going on here.”

By contrast, U.S. Sen. Ruben Gallego, an Arizona Democrat, graduated from an elite university, Harvard, and after serving in the Iraq War, was a political aide and state lawmaker. Gallego noted, correctly, he is one of the Senate’s poorest members, with a net worth of $121,500. “If we don’t put guardrails in,” Gallego, 45, said at the July 30 committee hearing, “there will be members of Congress that are going to benefit from this, without a doubt, and there will be a further erosion in trust, among Democrats and Republicans, in government.”

Craig Holman, lobbyist for Public Citizen, a nonprofit consumer advocacy group, told The Center Square he was not surprised by a class divide over the stock ban. “Wealthier members of Congress are the ones who would make the most by exploiting stock trading and have the wealth to take those types of risks,” he told The Center Square. “Less wealthy members invest their savings in something more long-term.”

Calls to restrict lawmakers from owning stock began as least as far back as 2012 when President Barack Obama in his State of the Union Address said, “Let’s limit any elected official from owning stocks in industries they impact.”No members of Congress stood up or applauded Obama’s plan, but lawmakers have warmed to proposals in the face of overwhelming public support for a stock ban.According to a 2023 University of Maryland poll, 86% of registered voters said they supported prohibiting members of Congress from trading stocks.

Lawmakers have sponsored numerous legislative proposals since 2020. Democrats have been more likely than Republicans to sign on as cosponsors. But getting a true reading on the partisan divide has not been possible. Neither the House nor Senate has ever voted on legislation to prohibit or restrict lawmakers from buying and selling stock.

In 2022, stock ban proponents thought their time had come. Speaker Nancy Pelosi, a Democrat and a former opponent of a stock ban, expressed openness to scheduling a vote on the bill. But six weeks away from the congressional midterm elections, a time when Democrats could have sought to protect their majority by voting on a strongly popular bill, Pelosi scuttled the measure.

Pelosi, 85, is among Capitol Hill’s wealthiest lawmakers. According to Quiver Quantitative, her net worth at $269.6 million ranked fifth. Her husband, Paul, is a venture capitalist who invests in real estate and technology stocks.

One issue does unite many elected officials regardless of their economic circumstances: They show few if any signs of wanting a stock ban applied to them.

Three years ago, Trump announced his support for a ban on lawmakers buying and selling stocks. “We want a ban on members of Congress getting rich by trading stocks with insider information,” he said at the announcement for his third presidential bid at Mar-a-Lago in Florida. “And many of our great members agree with that.”

Hawley, the Missouri Republican, is the main legislative sponsor of a measure that would ban stock trades not only by lawmakers but also the president and vice president.When Trump learned that the bill would apply to him, he denounced Hawley as a “pawn” of Democrats and “a second-tier senator.” After Hawley amended the bill to exclude Trump, White House spokeswoman Karoline Leavitt clarified that the president “supports the idea of ensuring that members of Congress and United States senators who are here for public service cannot enrich themselves.”

Members of Congress who support a ban would likely not be subject to one for more subtle reasons. They are running for statewide office.

The month before his press conference at the Capitol on Sept. 3, Roy, the bill’s sponsor, announced he was running for attorney general of Texas next year. U.S. Rep. Ralph Norman, a South Carolina Republican and the bill’s wealthiest original cosponsor, had also announced in July he was running for governor.

Rep. Abigail Spanberger, a Virginia Democrat, sponsored a House version of the bill from 2020 until she stepped down from Congress in January. Now she is the Democrats’ nominee for governor of the Old Dominion State.

John Feehery, a lobbyist, columnist, and former spokesman for Republican House Speaker Dennis Hastert, said lawmakers’ runs for higher office show that a stock ban is a bad idea.

“It’s popular and populist, but it reinforces the idea that members are corrupt,” Feehery told The Center Square. “How much do they want to prostrate themselves at the altar of the American people? It hurts the institution.”

Then again, Feehery said a ban could become law.“Some of these populist bills take on a life of their own, and they could pass,” he said.

Latest News Stories

Texas House passes Congressional redistricting bill after absconding Dems return

Department of Education ends support for political activism

Illinois trucker warns foreign firms faking logs, dodging rules, risking safety

Illinois law mandates pharmacies to sell needles, sparking safety debate

Report warns U.S. national debt predicted to pass $53 trillion by 2035

Courts remain firm against unsealing grand jury records from Epstein trial

White House TikTok garners 1.3 million views in 24 hours

Newsom responds to Bondi’s letter on sanctuary policies

U.S., NATO military officials discuss Ukraine security guarantees

Illinois quick hits: Governor bans school fines; Target fires hundreds over fraud

Industry advocates: More state regulation will drive insurance rates higher

Lawmakers, policy groups react to social media warning suit