U.S. debt tops $38 trillion for first time

The U.S. national debt reached $38 trillion amid a partial federal government that costs taxpayers $400 million daily to pay furloughed federal workers to stay home.

The U.S. Treasury Department’s official counter topped $38 trillion for the first time on Wednesday. The milestone comes about two months after reaching $37 trillion in mid-August.

Maya MacGuineas, president of the Committee for a Responsible Federal Budget, said the situation was grim.

“While nominal gross federal debt may not be the most meaningful measure of our fiscal health, the rest of our fiscal situation is just as bleak,” she said. “Debt held by the public – economists’ preferred measure of debt – is already as large as our entire economy, beyond any point outside of a world war.”

She added: “Something has to give – and eventually it will, whether we are prepared for it or not.”

Michael Peterson, CEO of the Peter G. Peterson Foundation, said it was “the latest troubling sign that lawmakers are not meeting their basic fiscal duties.”

“Along with increasing debt, you get higher interest costs, which are now the fastest growing part of the budget. We spent $4 trillion on interest over the last decade, but will spend $14 trillion in the next ten years. Interest costs crowd out important public and private investments in our future, harming the economy for every American,” he said. “Lawmakers need to realize that the financial markets are watching. All three credit ratings agencies have dropped U.S. credit below their highest rating, citing both our unsustainable fiscal outlook and political gridlock.”

Each day the federal government remains closed will cost U.S. taxpayers about $400 million just in salary for about 750,000 furloughed federal workers. Workers won’t collect that backpay until after they return to work when the shutdown ends.

The federal government has been partially shutdown since Oct. 1 after Congress failed to pass a spending plan on time. Both parties have blamed each other.

In March, the Congressional Budget Office said U.S. debt held by the public is on track to reach its highest level ever in 2029 before reaching 156% of gross domestic product in 2055. Gross domestic product is a measurement of economic output.

“Mounting debt would slow economic growth, push up interest payments to foreign holders of U.S. debt, and pose significant risks to the fiscal and economic outlook; it could also cause lawmakers to feel constrained in their policy choices,” the CBO report noted.

A January report by the Government Accountability Office warned that unchecked spending could increase public debt to 219% of GDP by 2051 and create a significant economic and national security risk.

“We project that public debt will reach an unprecedented level by 2027,” said Gene Dodaro, U.S. Comptroller General and head of the GAO. “We’re calling on Congress and the Administration to act now to develop and implement a strategy to address this acute challenge. Inaction could result in great difficulties for many Americans and impede policymakers’ flexibility to respond to future economic recessions or unexpected events.”

Latest News Stories

Dems oppose Trump’s bid to end mail-in ballots, voting machines

Trump says court’s tariff decision could lead to ‘catastrophic’ collapse

After two weeks fleeing Texas, House Democrats return, quorum reached

Trump: Zelenskyy could end Russia-Ukraine war ‘if he wants to’

$750 million facility to protect Texas cattle, wildlife from screwworm threat

Chicago posts fewest homicides since 2016, arrests rate also declines

Three years later, Inflation Reduction Act blamed for higher Medicare costs

Illinois quick hits: Prosecutors charge two more in Tren de Aragua case; Senate Energy and Public Utilities Committee meets today; Illinois Little League team loses in World Series

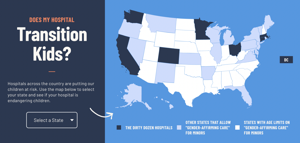

Report: Human Rights Campaign pressures transgender procedures on minors

Everyday Economics: Housing market and Fed policy in focus in the week ahead

Businesses brace for new tax challenges amid global tariff focus