Op-Ed: Main Street businesses, customers would bear brunt of a tax on services

Even as lawmakers reconvene in Springfield for the fall veto session, special interest groups continue to press for higher taxes on everyday services – such as haircuts, tax filings, and vehicle repairs – to fund their pet programs.

Last week, a memo circulating around the capitol included a potential $2.7 billion statewide service tax, euphemistically dubbed as “Sales Tax Modernization.”

This proposed tax on services would disproportionately hit Main Street businesses and their customers.

It would apply to everyday services that working families and seniors depend upon, such as home repairs, haircuts, pet care, accounting, tax services, landscaping, and vehicle repairs.

These services are normally provided by local small businesses – plumbers, landscapers, beauticians, accountants, electricians, lawyers, mechanics and many, many others.

These small businesses have been fighting to contain costs and limit price increases for their customers even as inflation has wrecked the buying power of everyday Americans.

It hasn’t been easy. Most small businesses have already had to raise prices to cover their costs and keep their doors open. Many have seen their customer base dwindle as fewer working Americans and seniors can afford the goods and services offered by Main Street businesses.

Too many consumers have been priced out of the market after years of rising costs. They are having to choose between home repairs, car repairs, or other basic services and putting healthy, wholesome food on their kitchen tables or keeping their thermostat at a comfortable temperature.

Putting a new tax on services will exacerbate this challenge for seniors and working families. As everyday Illinoisans are forced to cut back on spending and delay projects and services, Main Street businesses will bear the brunt of these reduced expenditures.

In addition to a decreasing customer base, small businesses will also have to absorb higher costs themselves. They will have to administer and collect the new service tax, which will impose new paperwork and administration costs on their businesses. They will also pay higher costs for the services that their business requires to operate – legal services, facility and equipment maintenance services, accounting and tax services, etc.

Small businesses lack the capacity to absorb more cost increases, so these costs will also have to be passed along to already stretched customers, further exacerbating affordability issues for price conscious consumers.

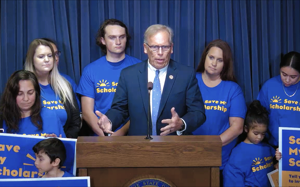

Legislators on both sides of the aisle in Springfield have voiced discomfort with this direct tax on working Illinoisians. Even as special interest groups continue to press for a service tax, many legislators understand how detrimental it would be to Main Street businesses and their customers. The ongoing affordability crisis makes it critical that the Illinois General Assembly shuts down these lingering rumors and talk of a service tax.

The last thing Illinois needs is a new tax on everyday services. Let’s let small businesses continue to do what they do best – serve their customers!

Latest News Stories

Texas House passes Congressional redistricting bill after absconding Dems return

Department of Education ends support for political activism

Illinois trucker warns foreign firms faking logs, dodging rules, risking safety

Illinois law mandates pharmacies to sell needles, sparking safety debate

Report warns U.S. national debt predicted to pass $53 trillion by 2035

Courts remain firm against unsealing grand jury records from Epstein trial

White House TikTok garners 1.3 million views in 24 hours

Newsom responds to Bondi’s letter on sanctuary policies

U.S., NATO military officials discuss Ukraine security guarantees

Illinois quick hits: Governor bans school fines; Target fires hundreds over fraud

Industry advocates: More state regulation will drive insurance rates higher

Lawmakers, policy groups react to social media warning suit