Audit Confirms Utility Losses as Casey Council Approves First Property Tax Hike in Five Years

Casey City Council Meeting | November 17, 2025

Article Summary: The Casey City Council approved a 3% property tax levy increase after an independent audit for the fiscal year ending April 30, 2025, confirmed a significant financial loss of $1.2 million in the city’s utility funds. Mayor Mike Nichols attributed the deficit to population decline and rising costs, stating the tax increase is necessary to stabilize city finances.

City Finances Key Points:

-

An audit by Gilbert, Metzger and Madigan LLP revealed a total decrease of $1.2 million in the city’s net position, primarily from utility operations.

-

The council approved Ordinance 593, establishing a new tax levy of $317,240, a 3% increase over the previous year.

-

This is the first tax levy increase in five years, following a cumulative 20% cut in 2020 and 2022.

-

Mayor Mike Nichols explained that state law restricts the city from using segregated utility reserve funds to cover deficits in other departments.

CASEY – Facing a confirmed $1.2 million deficit in its utility funds, the Casey City Council on Monday, November 17, 2025, approved a 3% increase in the city’s property tax levy, the first such hike in five years.

The decision followed a presentation of the city’s annual audit by Kelsey Swing of Gilbert, Metzger and Madigan LLP. The audit, for the fiscal year ending April 30, 2025, resulted in an unmodified or “clean” opinion but highlighted a $1.2 million decrease in the net position of the city’s business-type activities, which include its water, sewer, electric, and gas utilities.

Mayor Mike Nichols had earlier connected the utility losses to a population decline of about 700 people and a loss of 35 to 50 paying households, which has reduced revenue while operational costs have risen.

The council approved Ordinance 593, setting the total tax levy to be collected at $317,240. Nichols noted that the city had previously cut property taxes by 15% in 2020 and an additional 5% in 2022, holding them steady for the past two years.

During a public forum, Nichols also clarified the city’s financial structure, explaining that large reserves in funds like the electric department cannot be easily transferred to cover other expenses. “If it’s designated a special fund, which a lot of the utility funds are, it cannot [be moved],” Nichols said. “It can loan to another fund, but that loan has to be paid back.”

The audit report showed the unrestricted net position for governmental activities was $1.6 million, while the business-type activities held $7.4 million. However, low balances were noted in the sewer and water funds specifically.

Latest News Stories

Exclusive: America’s HealthShare launches as alternative to ‘broken’ healthcare system

Senators, pro-life group seek answers on FDA approval of abortion pill

Cartel bounties on ICE agents similar to bounties placed in Texas communities for years

Trump slices China fentanyl tariff in half following meeting with Xi

White Oak Pastor Mike Martin Guest Speaker at Rotary

ISP Arrest Man Charged with Aggrivated DUI and Reckless Homicide in Westfield Crash

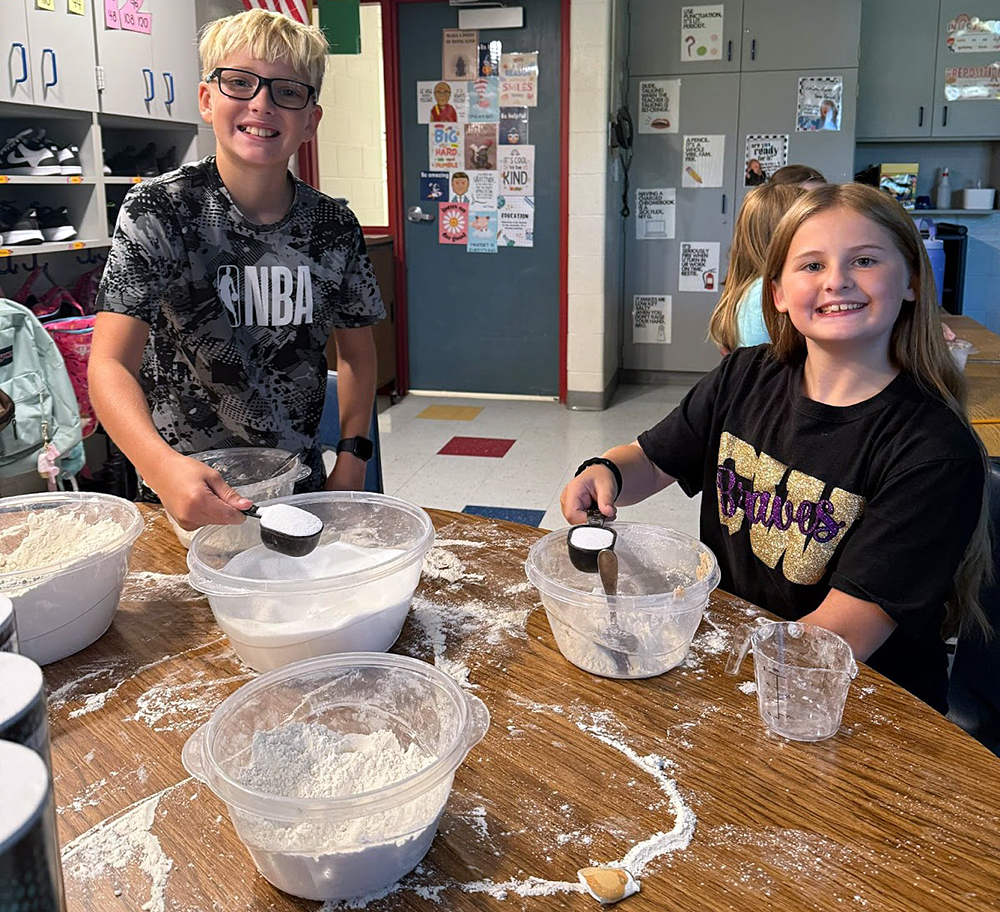

A Recipe for Fun: Fifth Grade Math Gets Hands-On

Trump orders Department of War to begin testing nuclear weapons

WATCH: Tax proposals draw questions from Pritzker and GOP state rep

Illinois quick hits: Former sheriff’s deputy guilty in Massey murder; appeals court intervenes in Bavino case

WATCH: Warnings of higher IL property taxes heard as pension bill advances

Top-selling automaker confirms U.S. investment, but no details yet

Fentanyl poised to take center stage during Trump, Xi meeting