Casey-Westfield Board Proposes 2025 Tax Levy, Sets Truth-in-Taxation Hearing

Casey-Westfield School Board Meeting | November 2025

Article Summary: The Casey-Westfield School Board reviewed a tentative tax levy that accounts for rising property values while opting for a lower rate increase than the statutory maximum.

Tax Levy Key Points:

-

Property Value Growth: The district’s Equalized Assessed Valuation (EAV) is expected to grow by approximately 17% due to reassessments.

-

Levy Decision: The Board reached a consensus to base the levy on a 7.5% EAV growth, resulting in an 8.45% overall increase over the 2025 extension.

-

Public Hearing: A Truth-in-Taxation hearing is scheduled for December 15, 2025, at 7:00 p.m.

The Casey-Westfield Community Unit School District C-4 Board of Education on Monday, November 17, 2025, discussed the tentative 2025 tax levy, opting to limit the tax increase despite significant growth in property assessments.

Superintendent Shackelford reported to the Board that the district’s 2025 Equalized Assessed Valuation (EAV) in Clark County is projected to rise by roughly 17% over 2024 figures. This spike is attributed to 2025 being a reassessment year for Casey. Shackelford noted that capturing the full extent of this growth could have resulted in a tax increase of up to 16% over the previous extension.

Following a review of the district’s needs assessment for the 2026-27 school year, the Board reached a consensus to adopt a more conservative approach. The tentative levy will be based on an EAV growth of approximately 7.5%, representing an overall increase of 8.45% over the 2025 extension.

Because the proposed levy exceeds a 5% increase, the district is required by law to hold a public hearing. The Board scheduled a Truth-in-Taxation hearing for 7:00 p.m. on December 15, 2025, at the Unit Office boardroom, located at 401 E. Main Street in Casey. The final 2025 tax levy is expected to be adopted during the regular meeting following the hearing.

Latest News Stories

Report warns U.S. national debt predicted to pass $53 trillion by 2035

Courts remain firm against unsealing grand jury records from Epstein trial

White House TikTok garners 1.3 million views in 24 hours

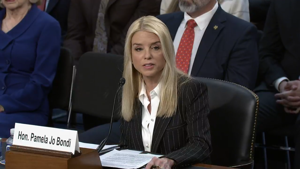

Newsom responds to Bondi’s letter on sanctuary policies

U.S., NATO military officials discuss Ukraine security guarantees

Illinois quick hits: Governor bans school fines; Target fires hundreds over fraud

Industry advocates: More state regulation will drive insurance rates higher

Lawmakers, policy groups react to social media warning suit

From Mexico to Knoxville, five cartel leaders wanted in drugs, weapons conspiracy

Trump administration pushes to remove noncitizen Medicaid enrollees

“Candy Canes on Main” Gets Green Light for Parade, Donation

Public education budgets balloon while enrollment, proficiency, standards drop