WATCH: IL legislator wants more transparency for taxpayer funded credit cards

(The Center Square) – A Democratic state legislator is looking to require more transparency for how local governments in Illinois use taxpayer funded credit cards.

State Rep. Anthony DeLuca, D-Chicago Heights, said his measure is simple.

“Too many times over the years, countless times over the years, we’ve seen headlines of overspending, credit card overspending, credit card abuse,” DeLuca told The Center Square. “And then at that point, the taxpayers are, they’re outraged and they’re demanding reform and accountability. And this creates more transparency.”

DeLuca filed House Bill 4196 earlier this month. He said the measure requires local governments to publish and vote on monthly credit statements.

“A unit of government would have to specifically and separately approve and vote on an itemized credit card statement from the previous month’s expenditures,” he said. “So really, all it’s doing is creating more transparency and more accountability.”

DeLuca said he will work with municipal advocacy groups on the potential mandate.

“There’s no cost. There’s no additional paperwork, really, in terms of just having the credit card statement be approved separately with the bill run or separate from the bill run, but at a meeting,” he said. “It’s more about posting it on a website where there could be a little extra time, not much, but it could create a little extra time.”

DeLuca also thinks his measure will spur on bipartisan support from his Republican colleagues.

“I hear from my constituents, from the most liberal constituents I have to some of the most conservative, there’s broad agreement on these type of issues,” he said. “There’s broad agreement on managing our taxpayer dollars as best we can about not misspending, about preventing duplication, about preventing fraud. They don’t want to see their tax dollars misused.”

The state legislature returns the third week of January.

Latest News Stories

Illinois law mandates pharmacies to sell needles, sparking safety debate

Report warns U.S. national debt predicted to pass $53 trillion by 2035

Courts remain firm against unsealing grand jury records from Epstein trial

White House TikTok garners 1.3 million views in 24 hours

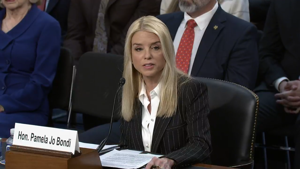

Newsom responds to Bondi’s letter on sanctuary policies

U.S., NATO military officials discuss Ukraine security guarantees

Illinois quick hits: Governor bans school fines; Target fires hundreds over fraud

Industry advocates: More state regulation will drive insurance rates higher

Lawmakers, policy groups react to social media warning suit

From Mexico to Knoxville, five cartel leaders wanted in drugs, weapons conspiracy

Trump administration pushes to remove noncitizen Medicaid enrollees

“Candy Canes on Main” Gets Green Light for Parade, Donation

Public education budgets balloon while enrollment, proficiency, standards drop