Everyday Economics: A consumer slowdown, fraying margins, and a big test for the Fed

Last week’s data told a clear story: the U.S. consumer is still standing, but looking increasingly tired – and businesses are starting to absorb more of the pain.

What We Learned Last WeekRetail sales:On the surface, retail sales barely grew. Once you adjust for inflation, Americans actually bought less stuff than the month before. That’s a warning sign heading into the holidays.Spending is also increasingly split along income lines. Households at the top – who saw their stock portfolios, home values, and savings swell during the pandemic – are still going out to eat, traveling, and shopping. But middle- and lower-income families are clearly tightening belts: trading down to cheaper brands, delaying big-ticket purchases, and watching every dollar more closely.That “two-track” pattern – strong spending at the top, caution or cutbacks below – is what economists mean when they talk about a K-shaped economy. The risk is that as more of the spending comes from a smaller share of households, growth becomes more fragile.Producer prices (PPI):Higher tariffs and input costs are still working their way through the system. But instead of passing those cost increases on to shoppers through higher prices, many wholesalers and retailers are quietly swallowing them.In plain language:Costs are up.Final prices haven’t risen as much.The gap is coming out of business profit margins.That squeeze is still modest, but it’s real – and it tends to get worse when customers start pushing back on price and volumes slip. Last week’s PPI report suggests we’re moving further into that phase.Consumer confidence:None of this is happening in a vacuum. Surveys show households feeling gloomier about the future. Job opportunities don’t look quite as plentiful as they did a year or two ago, and wage growth is cooling. That combination – softer job prospects and slower income gains – usually leads to more cautious spending, especially for families that don’t have a lot of financial cushion.Put together, last week’s data painted a picture of an economy that’s still growing, but increasingly dependent on higher-income consumers, with businesses quietly giving up margin to keep prices in check.What to Watch This WeekNow we turn from the checkout aisle to the showroom floor, the services sector, and the Fed’s favorite inflation gauge.1. Auto sales: the summer bump is goneThe upcoming auto sales report is likely to confirm what dealers and manufacturers already know: the summer pickup in sales didn’t last.Sales have cooled again after that brief burst of demand.Profit margins are under pressure as incentives creep back in.New vehicle prices are basically flat compared with a year ago – a stark contrast with the big price jumps earlier in the pandemic recovery.That’s good news for inflation, but it underscores how sensitive big-ticket purchases are to high interest rates and slowing income growth.2. ISM Services PMI: a slowdown in the engine of the economyServices are the backbone of the U.S. economy, and the ISM Services PMI is a real-time indicator of how that engine is running.In September, the survey’s business activity index slipped to 49.9% – essentially the line between growth and contraction, and the weakest reading since early 2010. October saw a small rebound in activity, but the employment index stayed in contraction territory.That’s the part to watch this week:If business activity softens again and the employment index stays in the red, it would signal that service-sector firms are losing confidence in the outlook and that layoffs could be next.Given how dominant services are in the U.S. economy, that would be a clear sign that the slowdown is broadening out.3. Personal income, spending, and PCE inflation: the Fed’s key inputWe’ll also get the September report on personal income, consumer spending, and PCE inflation – the Fed’s preferred inflation measure. This is effectively the last big inflation print before the Fed’s December interest-rate decision.Here’s the setup:Since new tariffs were announced, inflation has ticked up a bit but remains relatively contained.At the same time, risks to employment are building as hiring slows and businesses turn more cautious.The recent government data blackout has made it harder than usual for the Fed to see the full picture in real time.The core issue now is not whether inflation is still uncomfortably high – it’s whether the economy is increasingly being propped up by a shrinking group of households and firms. When growth rests on such a narrow base, the downside risk to jobs and incomes becomes more serious.As of December 1, futures markets were putting the odds of a December rate cut at roughly 86%.

Latest News Stories

Courts remain firm against unsealing grand jury records from Epstein trial

White House TikTok garners 1.3 million views in 24 hours

Newsom responds to Bondi’s letter on sanctuary policies

U.S., NATO military officials discuss Ukraine security guarantees

Illinois quick hits: Governor bans school fines; Target fires hundreds over fraud

Industry advocates: More state regulation will drive insurance rates higher

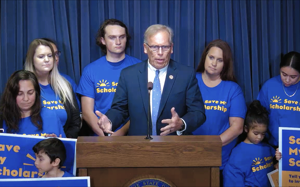

Lawmakers, policy groups react to social media warning suit

From Mexico to Knoxville, five cartel leaders wanted in drugs, weapons conspiracy

Trump administration pushes to remove noncitizen Medicaid enrollees

“Candy Canes on Main” Gets Green Light for Parade, Donation

Public education budgets balloon while enrollment, proficiency, standards drop

Illinois news in brief: Cook County evaluates storm, flood damage; Giannoulias pushes for state regulation of auto insurance; State seeks seasonal snow plow drivers